How To Check Vat Number In Ksa

Introducer y rate was 5 but it tripled in 2020.

How to check vat number in ksa. All united kingdom uk vat registration numbers have nine digits. It has just one vat rate and it is 15 from 1 st of july 2020. Say you select a vat account number. 1 vat account number 2 commercial registration number 3 vat certificate no.

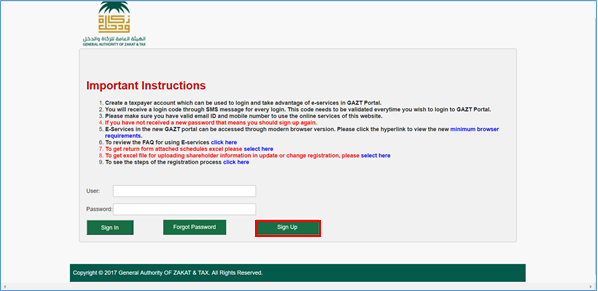

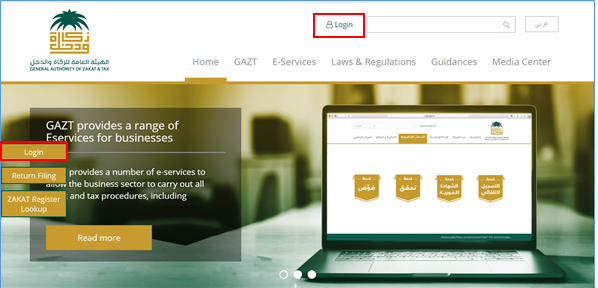

Suppliers and consumers can verify their vat registration number on the gazt website. Searching by vat account number is a recommended method. You can find the vat account number on the invoice examples below. Uae 800 82559 saudi 800 2442559 bahrain 800 12559 mena.

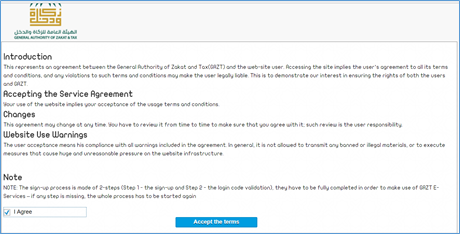

Enter the vat number you would like to validate. Select your search parameter vat account number company registration number or vat certificate number step 2. Enter the exact parameter number in the search field step 3. Certificate data will be displayed if it exists.

You can check a vat registration number in two ways the first and simplest although the least reliable method is to use the vat. Value added tax also is very new tax in saudi arabia. Enter the exact parameter in the search field. Non ksa residents who make taxable sales and purchases in the kingdom are required to register for and pay vat.

Select verify vat registration certificate service. Value added tax or vat is an indirect tax imposed on all goods and services that are bought and sold by businesses with a few exceptions. Select verify service from the list of online services. Click on search button to obtain the results.

8008445940 8008500478 8008500482 frequently asked questions on vat. You can search by vat account number comprised of 15 digits. The vat registration in ksa is a 5 step process let us understand the steps to apply for vat registration in saudi arabia in detail. Vat is applied in more than 160 countries around the world as a reliable source of revenue for state budgets.

In saudi arabia there is very simple value added tax system. Input the mentioned verification code and click on send button.